Key Questions to Reflect On

- Why does the sugar industry present a sweet investment opportunity during market fluctuations?

- How do global production and consumption trends, as well as the sugar trade balance, impact the market?

- What regulatory frameworks, sugar cycles, and diversification strategies shape India’s sugarcane landscape?

- Which sugar stocks in India are performing well, and how can they sweeten your portfolio?

These questions provide a framework for understanding the dynamics of the sugar industry, but there are many more facets to explore. Stay tuned as we delve deeper into the evolving landscape and uncover additional insights and analyses.

Amid increased volatility in global markets, some analysts are predicting a potential recession in 2025. If global markets experience significant downturns, the Indian stock market is likely to be adversely affected as well. Recently, the US Federal Reserve implemented a 50 basis point cut in interest rates, with indications of further reductions in the near future. This decision reflects growing economic tensions and uncertainty in the global economic landscape.

Some may argue that discussions of an impending recession are unfounded, especially since they have persisted for the past two years. In the stock market, perfection is elusive; no one can accurately time market movements. Instead, investors should focus on adjusting their portfolios according to their risk appetite. Given the current market volatility, it may be prudent to consider investments in sectors that tend to be more resilient during economic downturns or market crashes, as they are likely to experience less severe declines compared to others.

One standout sector is the sugar industry. Considered a defensive play, it enjoys stable demand even during economic slowdowns. This resilience makes sugar stocks attractive for investors seeking security and consistent returns in uncertain times, presenting a sweet opportunity to navigate market volatility.

The Sweet Gains: Why Investing in Sugar Industry is a Smart Move Amid Market Fluctuations

- Defensive Nature : The sugar industry is considered defensive, meaning that demand for sugar remains relatively stable even during economic slowdowns. This resilience makes sugar stocks attractive for investors looking for security and consistent returns, especially in uncertain times.

- Portfolio Diversification : Adding sugar stocks to a portfolio offers diversification benefits, as the sugar industry’s performance is generally uncorrelated with sectors like technology, finance, or healthcare. This reduces overall portfolio risk by spreading exposure across different industries.

- Revenue Diversification : Many Indian sugar companies have diversified into related sectors like ethanol production and power cogeneration. This strategy mitigates risks from fluctuating sugar prices while creating new revenue streams and growth opportunities.

- Growth Potential : With increasing global demand for sugar and its applications across various sectors (e.g., food, beverages, bioenergy), sugar stocks have considerable growth potential. Companies that innovate or optimize production can capitalize on this trend, providing strong returns to investors.

- Dividend Income : Many well-established sugar companies have a history of paying regular dividends to shareholders. This creates an additional source of passive income for investors, making it particularly appealing to those seeking consistent returns alongside potential capital appreciation.

- Government Support : The government plays a crucial role in supporting the sugar industry through subsidies, price controls, and other favorable policies. This government backing enhances the stability and profitability of sugar companies, creating a safer investment environment.

Having explored the significance of the sugar industry during periods of market volatility, let’s now delve deeper into the Indian sugar industry and analyze the top-performing stocks within this sector as well.

Decoding the Sweet Success: A Deep Dive into the Sugar Industry

The sugar industry is a cornerstone of the global agro-economy, particularly in tropical and subtropical regions. Centered on the cultivation of sugarcane and sugar beets, the industry produces not only raw and refined sugar but also valuable by-products like molasses, ethanol, and bioenergy. As a major driver of rural employment and a significant revenue stream for many nations, it plays a vital role in economic development and food security.

However, the industry operates in a highly regulated and cyclical environment, with production and pricing heavily influenced by trade policies, weather conditions, and fluctuations in domestic and international demand. Regulatory measures, including tariffs, subsidies, and production quotas, often create price distortions, making the sugar industry a complex and dynamic sector to navigate.

Sugar Powerhouses: Exploring the Production and Consumption Dynamics Globally

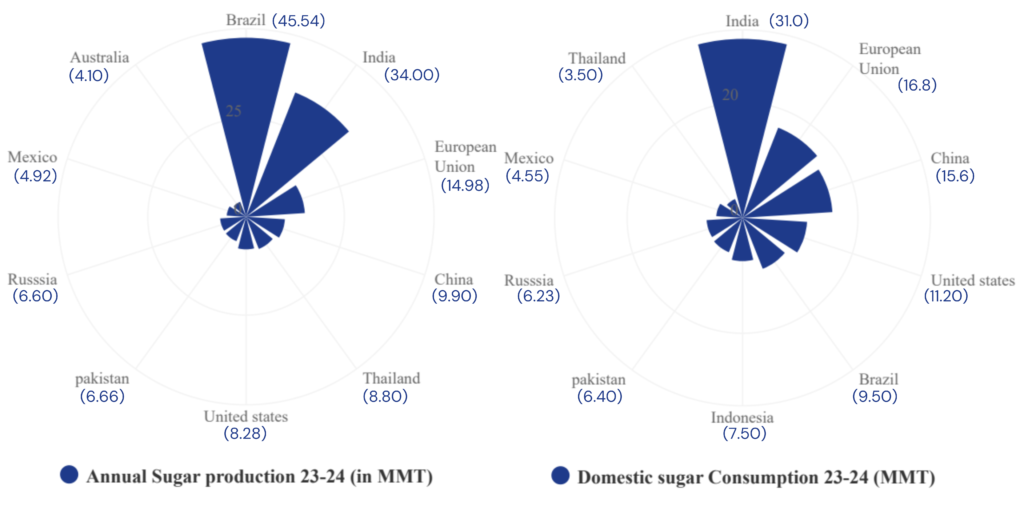

Brazil leads global sugar production but has relatively low domestic consumption, underscoring its role as a key exporter in the international sugar market. India, by contrast, is not only a top producer but also the largest consumer, driven by high internal demand. Other regions, such as the European Union and China, while moderate producers, show significant domestic consumption, reflecting a strong reliance on locally produced sugar.

Meanwhile, countries like the United States and Mexico, with lower production capacities, maintain substantial consumption, indicating a dependence on sugar imports. This distinction between production and consumption highlights the varying economic roles these countries play in balancing local demand with global trade. 1 MMT= 1 million metric tonnes = 10,00,000,000 Kgs

The global sugar market is marked by a production surplus, with Brazil and India continuing to dominate global supply. Consumption growth is being driven by India and other emerging economies, particularly in Asia. Global production and consumption figures indicate slight fluctuations, with total world production projected to reach 186 Million Metric tons and consumption to 178 Million metric tons by 2024/25.

Global Sugar Flow: Understanding the Import and Export Balance Across Leading Nations

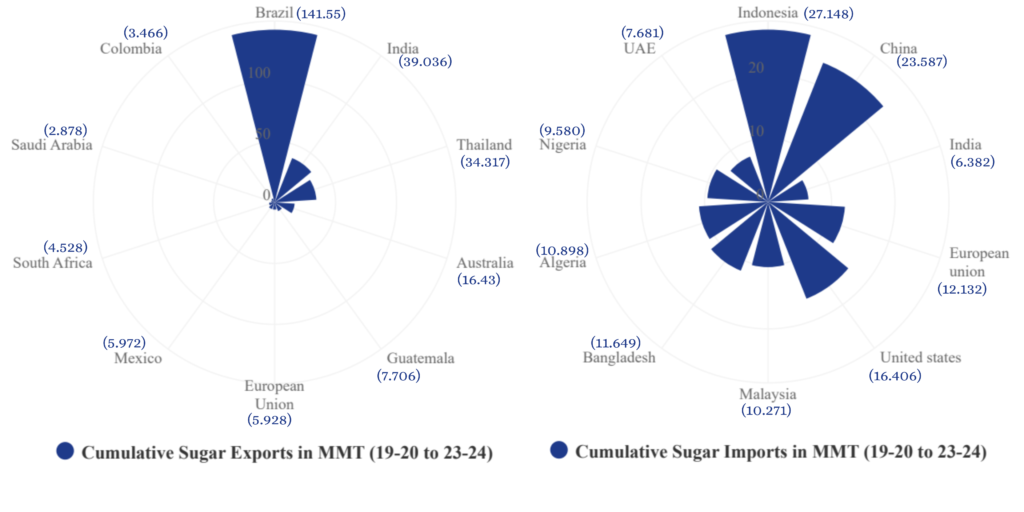

The Cumulative global sugar trade from 2019 to 2024 shows clear leaders in exports and imports. Brazil dominates exports due to its vast sugarcane production, with India close behind, supported by strong domestic output. Thailand and Australia also play key roles, while countries like Mexico and the European Union contribute despite internal challenges.

On the import side, Indonesia leads due to high consumption outpacing local production. China and the European Union also import heavily, driven by demand and trade needs. Nations like Bangladesh, Malaysia, and the UAE rely on imports due to limited domestic production, highlighting Brazil and India’s export dominance and rising import needs in developing regions.

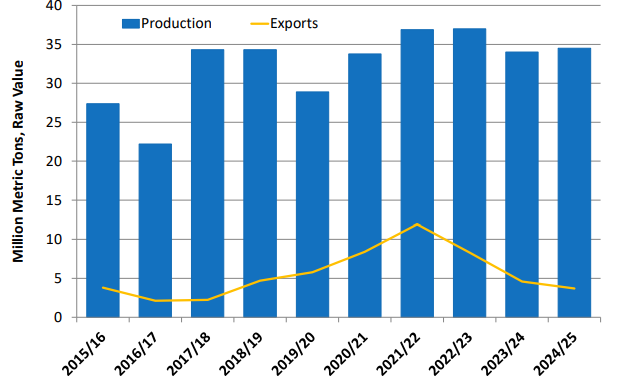

India Sugar Production Forecast Up with Exports Down

India’s sugar production is set to rise by 500,000 tons to 34.5 million, driven by higher yields and early maturing varieties. Growing demand from festivals, pre-packed foods, and catering is boosting consumption. Imports are expected to increase as consumption outpaces production, while exports may dip slightly due to government caps prioritizing domestic needs and ethanol production for the Ethanol Blending Program.

NOTE: All the figures presented above are sourced from the USDA. For a comprehensive understanding, readers can explore the detailed report. READ DETAILED USDA REPORT.

From Policy to Production: Understanding India’s Sugarcane Landscape

India, as the second-largest sugar producer globally, relies heavily on its sugar industry for economic growth. This sector is a key agro-based industry, providing employment to millions and contributing significantly to national income. The government plays a crucial role in regulating the industry, ensuring fair prices for both sugarcane farmers and consumers.

Several factors drive the demand for sugar in India, including population growth, evolving dietary preferences, and the increasing use of sugar in various industries such as food processing, beverages, and pharmaceuticals. Additionally, rising sugar exports have further boosted the industry’s growth, solidifying India’s presence in the global market.

Before diving into sugar stocks, it’s essential to grasp the key factors that shape this market. From navigating regulatory landscapes to understanding commodity cycles, climatic influences, and diversification strategies, being well-informed can empower your investment decisions.

1. Regulatory Framework Shaping the Sugar Industry

- Cane reservation area and bonding: Every designated mill is obligated to purchase from cane farmers within the cane reservation area, and conversely, farmers are bound to sell to the mill. This ensures a minimum supply of cane to a mill, while committing the mill to procure at a minimum price.

- Minimum distance criterion: Under the Sugarcane Control Order, the government mandates a 15 km minimum distance between sugar mills to ensure sufficient cane supply. However, this rule creates market distortions, giving mills monopolistic power over small farmers and limiting competition and new investment.

- Price of sugarcane: The central government fixes a minimum price, the Fair and Remunerative Price (FRP) that is paid by mills to farmers. States can also intervene in sugarcane pricing with a State Advised Price (SAP) to strengthen farmer’s interests. Typically, SAP is higher than FRP. There have been divergent views on which is a fair price to both farmers and millers.

- Levy sugar obligation: Every sugar mill mandatorily surrenders 10% of its production to the central government at a price lower than the market price – this is known as levy sugar. This enables the central government to get access to low cost sugar stocks for distribution through PDS. At present prices, the centre saves about Rs 3,000 crore on account of this policy, the burden of which is borne by the sugar sector.

- Regulated release of non-levy sugar: The central government allows the release of non-levy sugar into the market on a periodic basis. Currently, release orders are on a quarterly basis. Thus, sugar produced over the four-to-six month sugar season is sold throughout the year by distributing the release of stock evenly across the year.

- Trade policy for sugar: The government regulates sugar exports and imports based on domestic availability, demand, and pricing, using a system of cascading controls and permits. Despite producing 17% of the world’s sugar, India’s export share is just 4%, leading to instability in the sugarcane industry and its production.

- Regulations relating to by-products: Restrictions on sugarcane by-products like molasses and bagasse limit their movement across states. State governments set quotas for molasses use and often restrict mills from selling power generated from bagasse outside local power utilities or across state lines. These limitations hinder revenue potential from cogeneration and reduce economic efficiency.

- Other issues: The Jute Packaging Materials (Compulsory use in Packing Commodities) Act, 1987 (JPMA) mandates that sugar be packed only in jute bags. The sugar industry estimates that this leads to an increase in cost by about 40 paise per kg of sugar besides adversely impacting quality. The committee recommended removing the sugar industry from the purview of the JPMA.

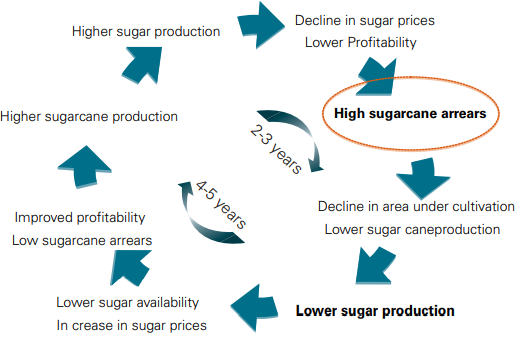

2. Decoding the Sugar Commodity Cycle

The sugar industry is cyclical and heavily regulated, with quotas, pricing controls, and tariffs distorting prices. In India, production follows a 3–5-year cycle, where high output lowers prices and profitability, leading to delayed farmer payments. As arrears grow, farmers shift to other crops, reducing sugarcane cultivation. This decline cuts production, raising sugar prices and profitability, which eventually restarts the cycle.

3. Climatic Conditions: The Key to Sugarcane Yield

Sugarcane, essential for sugar and bioenergy, is mainly grown in tropical and subtropical regions. Climate factors like CO2 levels, temperature, precipitation, and extreme weather significantly influence global production. Climate change has led to fluctuating yields in areas such as Zimbabwe, Fiji, and China, with Fiji experiencing sharp declines during droughts and record production in favorable weather conditions.

Drought is the primary stressor, particularly in rainfed regions like China, reducing both cane and sucrose yields. Waterlogging also threatens production, while rising temperatures contribute to the spread of diseases like smut and rust in sugarcane fields, especially in Florida, USA.

The recent fire in Brazil, which accounts for 25% of global sugar production and 50% of exports, has disrupted the global sugar supply chain, destroying 500,000 hectares of sugarcane fields and reducing production by 5–10%. This shortage has driven sugar prices up from $0.20 to $0.25 per pound. India, the second-largest sugar producer, is well-positioned to fill this gap. As a result, Indian sugar companies like Balrampur Chini Mills, Dhampur Sugar Mills, and Dalmia Bharat Sugar have seen stock prices surge by 10% to 15%.

4. Diversification Strategies in the Sugar Sector

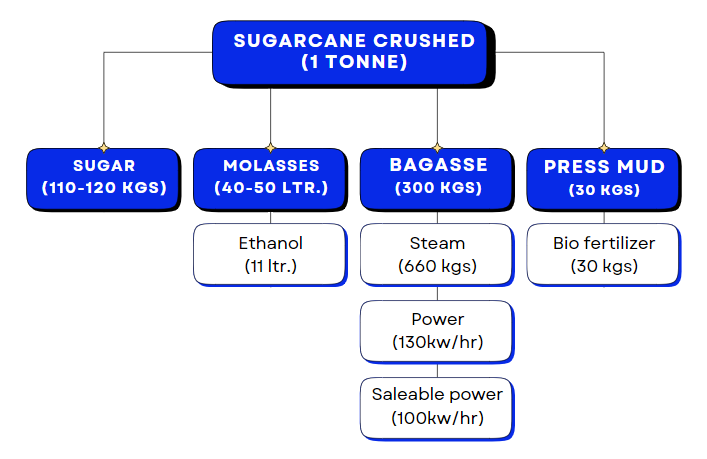

sugar companies diversify to increase their profit margins by leveraging every by-product of sugarcane processing. This diversification helps them mitigate risks related to volatile sugar prices and ensures multiple streams of revenue. Key areas include ethanol production, power generation, branded sugar products, and bio-fertilizer production.

- Sugar Production: Sugar companies primarily derive their revenue from sugar extracted from sugarcane. However, by offering branded sugar products, such as those from Balrampur Chini Mills and Shree Renuka Sugars, they add value to their production and capture a larger market share through consumer branding.

- Ethanol Production: Ethanol, produced from molasses, is crucial to India’s ethanol blending program. Companies like Balrampur Chini Mills and Dalmia Bharat Sugar have increased production, diversifying revenue and stabilizing cash flow while reducing reliance on sugar prices.

- Power Generation: Bagasse, a by-product of sugarcane processing, is used in cogeneration plants to produce steam and electricity. Companies like Triveni Engineering and Dhampur Sugar Mills generate power from bagasse, selling surplus to the grid or using it internally. This adds a revenue stream and reduces energy costs.

- Bio-fertilizers: Press mud, a waste by-product, can be processed into bio-fertilizers, allowing sugar companies like Bajaj Hindustan Sugar to diversify into agribusiness. This eco-friendly product meets farmers’ needs while enhancing profitability.

Navigating the Sweet Market: An Overview of India’s Best Sugar Stocks

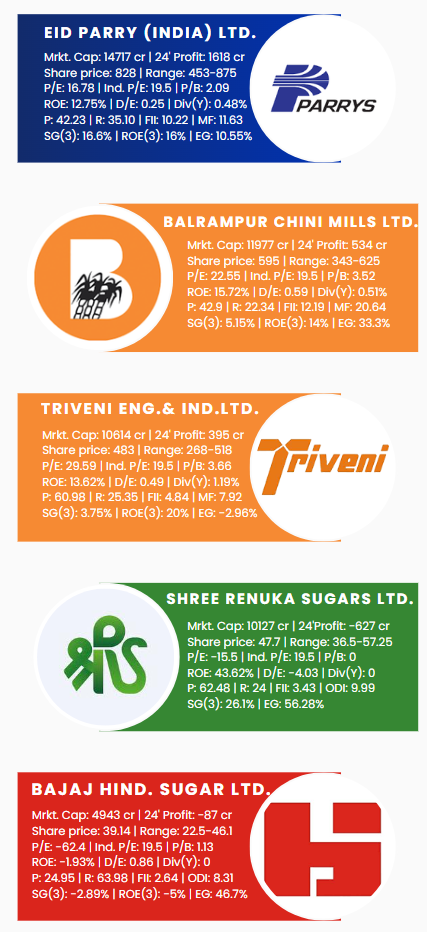

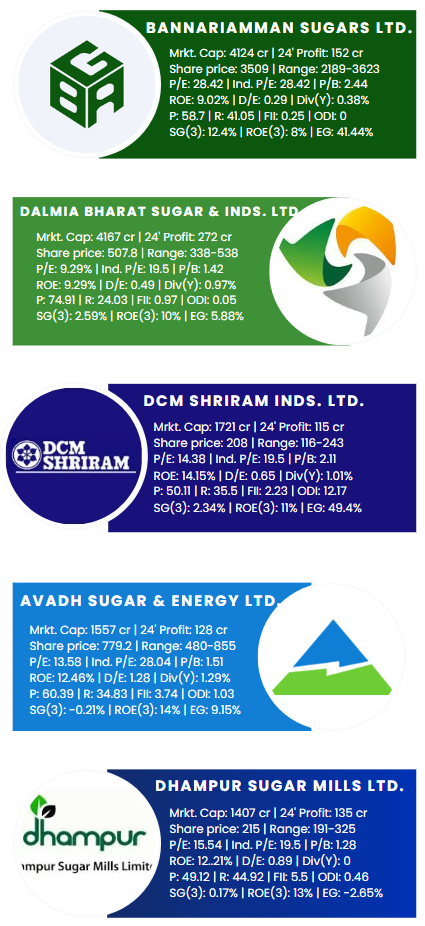

Note: We have mentioned top 10 sugar companies based on Market capitalization. The stock list mentioned below is not exhaustive. Here’s a brief guide to the abbreviations used in the company analysis: To explore the indicators further, check out the last section of our previous post- Is India’s Defence Sector the New Long-Term Stock Market Theme? Key Drivers and Performance Analysis

Mrkt. Cap.: Market capitalization | 24′ Profits: FY 23-24 profits | Share Price: Current stock price | Range: 52-week low and high | P/E: Price-to-earnings ratio (compared with Ind. P/E for industry average) | P/B: Price-to-book ratio | ROE: 1-year return on equity | D/E: Debt-to-equity ratio | DIV(Y): Dividend yield | P, R, FII, MF, ODI: Promoters, Retailers, Foreign Institutional Investors, Mutual Funds, Other Domestic Investors | SG(3): 3-year CAGR in sales | ROE(3): 3-year CAGR in return on equity | EG: EBITDA growth last 03 year.

Conclusion:

India’s sugar industry presents promising investment opportunities for individuals seeking to diversify their portfolios and capitalize on the consistent demand for sugar. By conducting thorough research and selecting top-performing sugar stocks, investors can enjoy substantial returns and participate in the growth of this crucial sector

Frequently Asked Questions

India’s sugar industry officially began with the establishment of its first sugar mill in Pratappur in 1903.

Uttar Pradesh is India’s largest producer of sugarcane, followed closely by Maharashtra and Karnataka.

Sugarcane is planted three times a year in India—October, March, and July—depending on the region.

Franz Carl Achard is known as the father of the beet sugar industry.