Key Takeaways

- The unemployment rate went up to 4.3% in July from 4.1% in June. Falling short of expectations, with only 114,000 new jobs added compared to the consensus estimate of 175,000, according to Morningstar.

- Goldman Sachs economists have increased the probability of a US recession in the next year to 25% from 15%.

- Despite strong results for Q2, the market remains uncertain about the U.S. economy, which may compel the Federal Reserve to implement a rate cut at its next meeting on September 18th.

The markets were still reeling from the Bank of Japan’s rate hike when fresh trouble emerged on August 2nd. The release of a disappointing job report only intensified the existing anxiety, triggering a massive selloff. Traders, already on edge, were thrown into a frenzy, leading to dramatic declines across major indices. Within just three trading sessions, the S&P 500 plummeted nearly 8%, the Dow Jones Industrial Average fell by 7%, and the Nasdaq Composite plunged by a staggering 11%.The July jobs report raised concerns that the US fed may be moving too slowly to address potential recession risks with rate cuts.

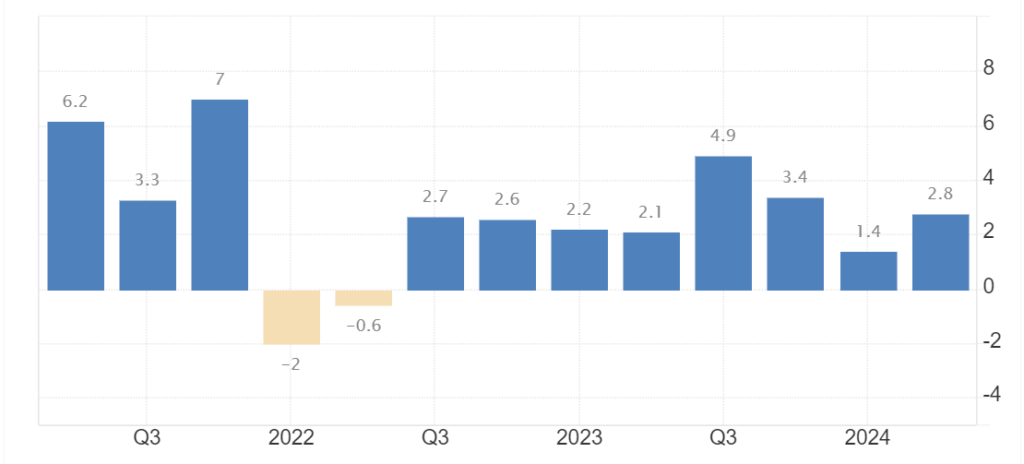

Is the recent labor market data signaling a significant shift towards a potential recession in the nation’s economic direction? To explore this, let’s consider the Q2 GDP data. The U.S. economy expanded at an annualized rate of 2.8% in Q2, up from 1.4% in Q1, exceeding the forecasted 2%. This growth was fueled by higher consumer spending, private inventory investment, and non-residential fixed investment, indicating positive economic momentum. Some experts suggest that the disappointing job report may have been influenced by weather-related work stoppages, rather than reflecting a broader economic downturn

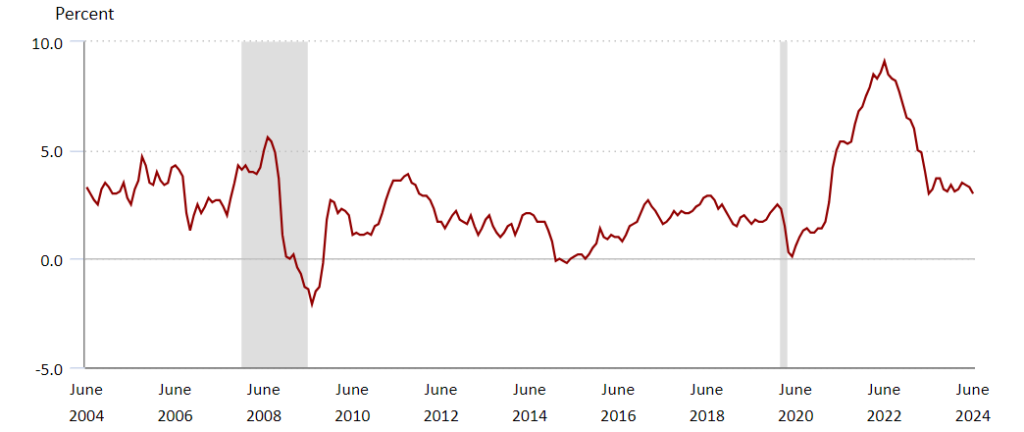

Investors are increasingly convinced that the Federal Reserve needs to act swiftly by cutting interest rates. The anticipation is building for a significant rate cut of 0.5% during the mid-September meeting. The Fed has indicated that its decision will be data-driven, with particular attention to labour market concerns. Given the current situation, many believe that the Fed will feel compelled to implement the rate cut, especially if the labour market continues to weaken, unless inflation rises unexpectedly.

Currently, U.S. inflation stands at 3.0%, above the Fed’s long-term target of 2%. However, it seems unlikely that the Fed will rigidly adhere to this target at the risk of exacerbating job losses. Balancing inflation control with job preservation may take precedence, leading to a more flexible approach in the coming months.

Consumers and businesses are feeling the strain of the Fed’s high interest rates, as borrowing has become significantly more expensive. This has dampened consumer purchasing power and limited businesses’ ability to invest in capital. A reduction in interest rates could alleviate these pressures, boosting purchasing power and encouraging investment. With these potential changes on the horizon, the threat of a recession seems less imminent.

HOW INDIAN STOCK MARKET GETS AFFECTED BY POTENTIAL US RECESSION.

While the likelihood of a U.S. recession seems minimal, it’s worth considering how the Indian stock market would respond if it were to occur. Though the market would inevitably face some impact, the effect would likely be much less severe than during the Dot-com Bubble in 2002 or the Financial Crisis of 2008.The Indian stock market fell by 56-57% during the Dot-Com Bubble and by 58-60% during the 2008 Financial Crisis.

Recent trends reveal a shift towards greater self-reliance in the Indian stock market, driven by strong participation from domestic institutional investors (DIIs). Historically, foreign investments played a key role, but this reliance has decreased significantly. For example, despite notable declines in global markets earlier this month, the Indian market showed impressive resilience. While global indices experienced their largest drop in over two years—Japan’s Nikkei falling more than 12% and the S&P 500 down 3%—India’s Nifty 50 only lost 2.7%. This highlights the Indian market’s superior ability to weather global economic turbulence.

The surge in DII involvement, with monthly Systematic Investment Plans (SIPs) approaching ₹20,000 crores, has fortified their role in stabilizing and lifting market performance, even in the face of external pressures. This substantial domestic investment has reduced our reliance on foreign capital, enabling the market to better weather global fluctuations.

India’s economic landscape also contributes to this stability. Unlike many economies grappling with recession fears, India continues to achieve robust growth, which bolsters investor confidence and attracts capital inflows. Should global economic conditions falter, India’s resilience positions it as a safe haven for investors seeking stability. In essence, the Indian stock market’s increasing self-reliance, combined with a strong domestic economy, equips it to sustain growth and stability, even amidst global economic uncertainties.

INTERNAL CHALLENGES OF SENSEX AND NIFTY

It’s important to acknowledge that while the Indian stock market might still face declines, its increased self-reliance has significantly reduced its vulnerability to external market shocks. Recent performance has been notably strong, leading to some investor apprehension about a potential major correction. Additionally, the market is grappling with specific internal challenges, such as the recent Hindenburg report, which has targeted the SEBI chairperson and could potentially complicate matters.

While these factors might lead to a negative market reaction, I personally believe that any corrections will likely be minor rather than severe. Overall, the market’s enhanced self-reliance suggests that it is less likely to be heavily impacted by external factors.

Frequently Asked Questions

A recession is a notable drop in economic activity sustained over an extended period, usually marked by two consecutive quarters of negative GDP growth.

As of August 2024, the current federal funds rate set by the Federal Reserve is indeed in the range of 5.25% to 5.50%. This rate has remained unchanged since July 2023.

When the BOJ raises interest rates, the cost of borrowing for US investors increases. This sudden rise can lead to a sell-off in US assets as investors seek to repay their debts, which can negatively impact the US stock market.

The next meeting is scheduled for 18th September. The Fed will review economic conditions and make decisions regarding monetary policy, including interest rate adjustments.

In its latest investigative report, Hindenburg has claimed that Buch and her husband had investments in obscure offshore entities involved in Adani’s alleged ‘money siphoning scandal.’

Well Researched.

I’m glad you liked it!

Excellent work

Thank you !! I would love to hear your thoughts on my latest post, ‘Adani VS Hindenburg’ too. Your feedback would be really valuable to me!