Key Questions to Reflect On

- How does India’s defence sector compare to China’s in terms of capabilities, technology, and strategic posture?

- What are the key drivers of growth in the Indian defence sector, and how are these factors influencing the industry’s development?

- What are the current trends in India’s defence imports and exports, and how do these trends align with the government’s targets and initiatives for achieving self-sufficiency in the defence industry?

- Which Indian defence companies are well-positioned to benefit from recent developments in the sector, and how is their performance being impacted?

These questions provide a framework for understanding the dynamics of the Indian defence sector, but there are many more facets to explore. Stay tuned as we delve deeper into the evolving landscape and uncover additional insights and analyses.

The defence sector is the backbone of a country’s social security, and self-reliance in this area is crucial. Dependence on foreign defense supplies can create leverage against your interests. India experienced this in the 1960s when the U.S. used food aid to exert pressure.

“Without self-reliance, India cannot take independent decisions on global issues in line with its national interests,” – Rajnath singh

India, as the world’s largest arms importer, faces potential external pressure in a conflict. The Russia-Ukraine war highlights the importance of defence self-reliance—despite 16,000 sanctions, Russia sustains its military through domestic capabilities. If India faced similar challenges, heavy reliance on foreign arms could make us vulnerable. While allies may offer temporary support, in diplomacy, no country is a permanent friend. True security lies in being self-sufficient in defence.

Thanks to our think tanks, India is taking steps toward self-reliance in defence. It’s easier said than done, but progress is visible. India is now among the top 25 arms exporters—a significant achievement. Though there’s a long way to go, these small steps are paving the path to greater success.

Now, the big questions: 1) what’s the future of our domestic defence sector? 2) how can we, as investors, capitalize on this evolving defense landscape? This post will explore the three most important key drivers of the Domestic defense sector in the coming years.

These three key drivers will significantly propel the growth of the defence sector in the future:

- Escalating Regional Threats from neighbouring countries

- Government Goals and Initiatives to Achieve Defence Self-Sufficiency and Minimize Arms Imports

- Government Goals for Boosting Defence Exports in the Coming Years.

In the later sections, we will also analyze various defense companies poised to benefit from these developments and their performance.

Key Driver No. 1: Escalating Threats from Neighboring Countries.

The escalating threats from neighboring countries, China and Pakistan, are driving India to intensify its focus on self-sufficiency in defence. As India boosts military capabilities and reduces reliance on foreign suppliers, domestic defence companies will benefit. This focus on local development and procurement tackles security issues and offers significant growth opportunities for Indian defence firms.

India vs. China & Pakistan: Comparing India’s defence capabilities with those of China and Pakistan helps evaluate current self-sufficiency. It also assesses readiness for potential conflicts over the next 15-20 years. This assessment helps gauge progress toward effective self-defence and readiness.

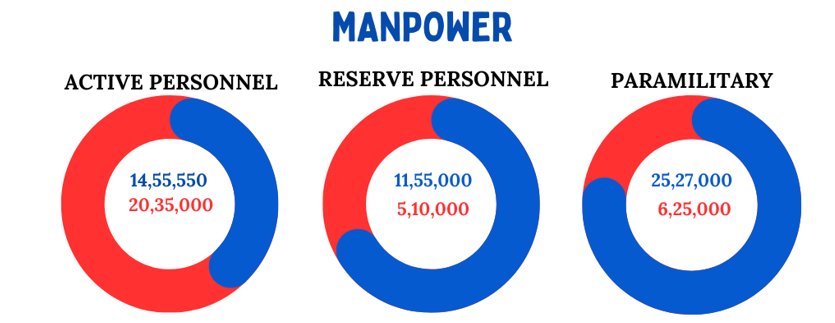

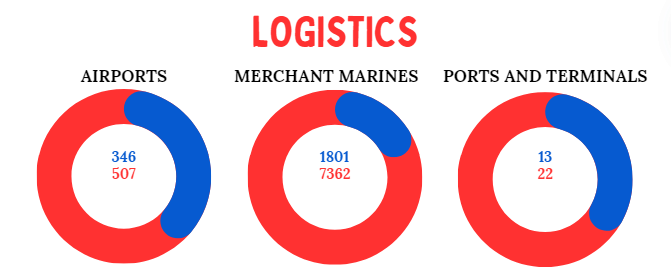

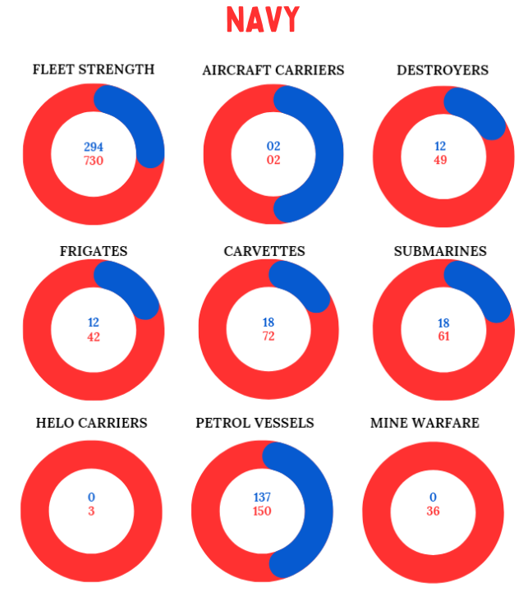

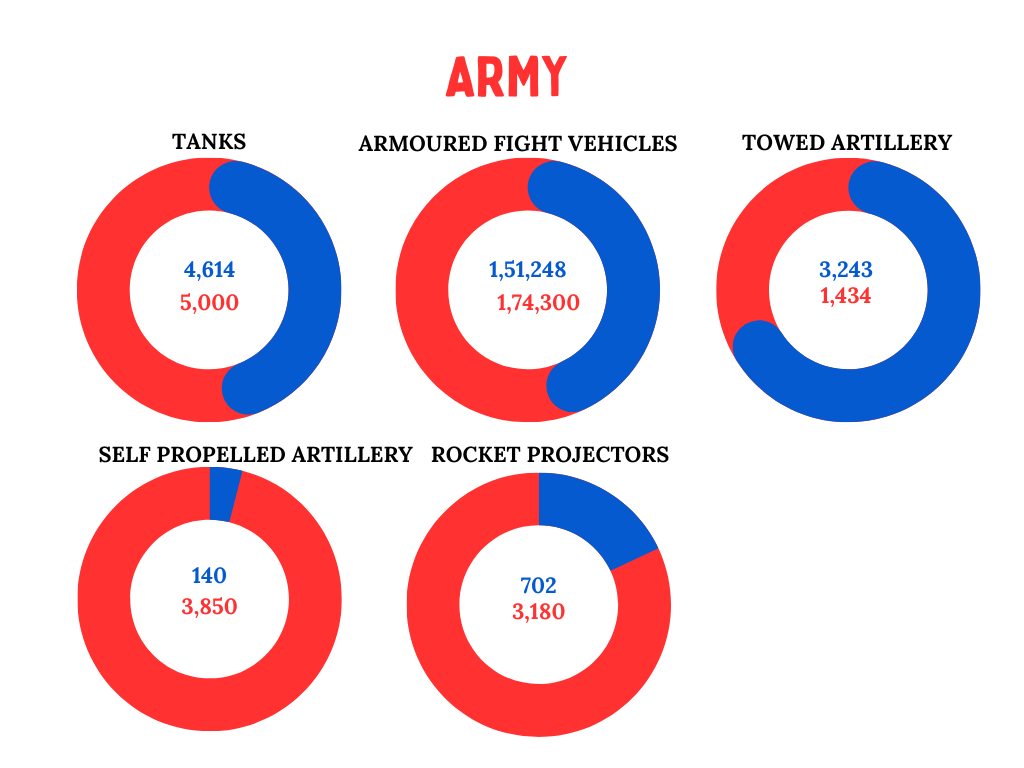

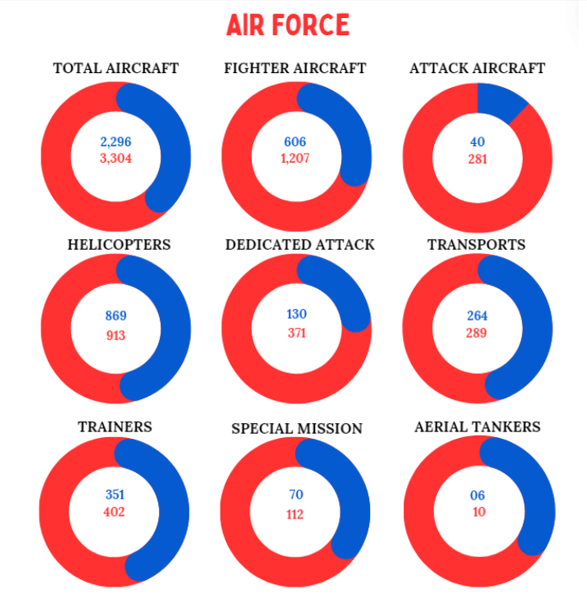

We will assess the arms gap between India and China, providing a comprehensive analysis of future demand for arms and ammunition. For Comparison purpose Red represents China and Blue represents India.

China has more active personnel, while India has a greater number of reserve and paramilitary forces, suggesting different strategic strengths.

China appears to have stronger logistics capabilities with more airports, merchant marines, and ports and terminals compared to India.

China has a stronger navy overall, with more fleet strength, destroyers, frigates, corvettes, submarines, and mine warfare vessels compared to India. India’s strength is more balanced with its specific focus on particular naval assets, but China’s naval capabilities are more extensive in multiple categories

China’s superior armored forces give it the edge, despite India’s artillery strength. The advantage leans toward China.

China’s air force holds an advantage with more total aircraft, fighters, and attack jets, offering greater air superiority. India’s strength lies in key areas, but China’s larger fleet gives it a strategic edge.

The comparison shows China surpassing India in defence capabilities across most areas. China leads in manpower, logistics, air force, and navy, with more personnel, aircraft, and naval vessels. In the army, China also has more tanks and armored vehicles. Additionally, China’s defence budget is nearly three times that of India’s, emphasizing the significant gap. To close, India must significantly increase defence spending. This will benefit Indian companies as indigenization efforts rise, boosting profitability in the domestic defence sector.

Recent developments show that China is rapidly improving its defence infrastructure and logistics along the border with India, posing a serious concern for India. In response, India must accelerate the enhancement of its military capabilities to keep pace with these advancements.

India VS Pakistan: India is stronger than Pakistan in several defence areas, including manpower, air power, naval power, natural resources, financial strength, and logistics. This indicates India’s larger military base, superior air and naval capabilities, greater access to resources, and better financial and logistical support. However, Pakistan holds an edge in land power, likely due to its ground forces, and in geography, which may offer strategic advantages. Overall, India leads in most defence metrics, while Pakistan has specific strengths in land power and geographical positioning.

India holds a clear advantage over Pakistan in several defence areas. However, the close alliance between Pakistan and China poses a more significant challenge. Analysts suggest that in a large-scale conflict involving India and either China or Pakistan, India may need to defend itself against both nations simultaneously. China would likely exploit such a conflict to weaken India strategically, using Pakistan as a proxy force.

To effectively compete with China and Pakistan, India must significantly expand its investments in arms, ammunition, and logistics. With the government’s focus on indigenization, Indian companies will be the primary beneficiaries, as defence contracts will increasingly favor domestic manufacturers. This shift is expected to boost the order books of Indian defence-related companies, driving growth in the sector.

Key driver no.2: Government Goals and Initiatives to Achieve Defence Self-Sufficiency and Minimize Arms Imports

Let’s start by analyzing India’s current defence spending and import trends, followed by an in-depth look at the government’s initiatives aimed at indigenization.

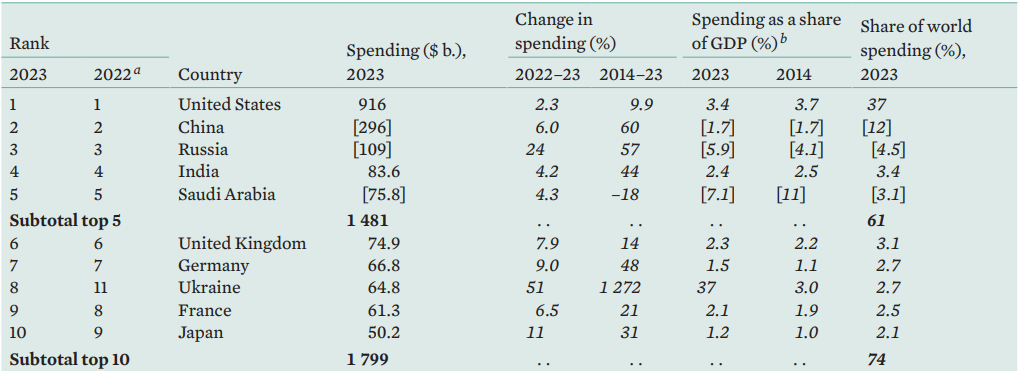

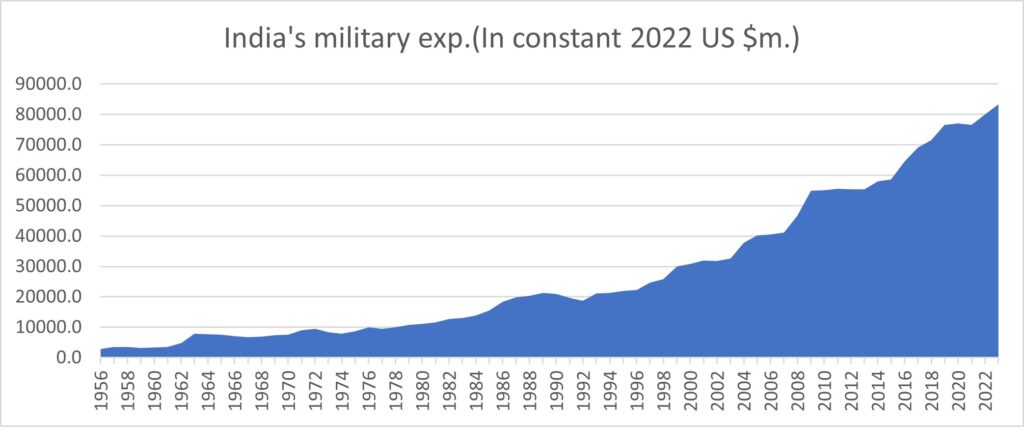

In 2023, India ranked as the fourth-largest military spender globally, with a defence budget of $83.6 billion, marking a 4.2% increase from 2022 and a 44% rise since 2014. The growth primarily stems from rising personnel and operational costs, which comprised 80% of the budget, reflecting India’s focus on strengthening armed forces amid tensions with China and Pakistan.

Defence is a sector where investment never ceases. Leading countries must consistently allocate funds for maintenance and modernization of their arms, especially with advancing technology. Governments are heavily investing in research to develop high-tech equipment, as every nation seeks to outpace others, while those at the top aim to maintain their dominance.

India’s military expenditure is steadily increasing, and given the current circumstances, it is expected to rise further. With the government’s emphasis on indigenization, capital investments will increasingly flow into domestic companies and startups, fostering local defence production.

Where does India stand in arms import ?

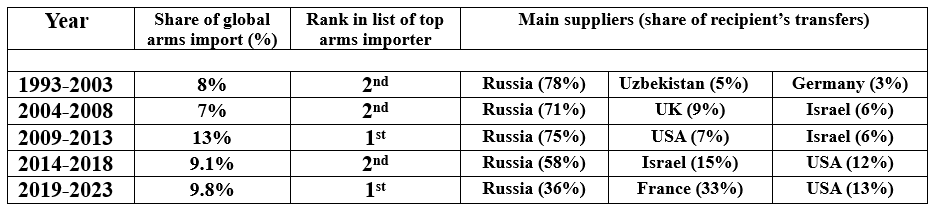

With 9.8 percent share of global arms imports in 2019–23, India retained its position as the largest importer of arms in the world. Its arms imports increased by 4.7 percent between 2014-18 and 2019–23. The major factors that contributed to the surge of India’s arms imports were the prevailing tensions with its two nuclear armed neighbours, China and Pakistan, which continue to pose big defence and security challenges to it.

Russia remains India’s primary arms supplier, but its share of Indian arms imports has dropped significantly—from 76% in 2009–13 to 36% in 2019–23. India is increasingly turning to Western suppliers, particularly France and the USA, as well as its own arms industry, to meet its defence needs. This shift is evident in new orders placed with Western suppliers and in India’s procurement plans, which appear to exclude Russian options.

With growing indigenization, India’s defence spending will increasingly shift from imports to domestic companies. While this transition will take time due to the long-term nature of defence deals, the reliance on imports will gradually decrease. The defence sector will remain a key focus and is set for long-term growth.

Discussing recent budget of 2024-25 and how it supports Indigenization:

For FY 2024-25, India’s Ministry of Defence received ₹6.22 lakh crore, a 4.79% increase from last year. Key allocations include ₹1.72 lakh crore for capital acquisition, ₹92,088 crore for operational readiness, and ₹1.41 lakh crore for defence pensions, with ₹6,968 crore for ECHS. Additionally, ₹6,500 crore is set aside for border roads, ₹7,651 crore for coastal security, and ₹518 crore for iDEX to boost defence innovation.

The focus on indigenization is evident from the steps taken by Indian govt. For the fiscal year 2024-25, ₹105,518.43 crores, or 75% of the total procurement budget, has been allocated for buying defence equipment from domestic industries. DRDO received ₹23,855 crore to boost indigenous technology, while the ADITI scheme was allocated ₹400 crore to support startups in AI and cyber defense.

Initiatives taken by govt. of India to support indigenization.

- Buy Indian-IDDM: A new category in the Defence Acquisition Procedure (DAP)-2016 to promote indigenous design and manufacturing of defence equipment.

- MAKE Projects: Under Make in India-Defence, this plan supports indigenous defense equipment development with both government and industry funding.

- FDI Limit: Increased from 49% to 74% for defense manufacturing under the automatic route, encouraging joint ventures with global firms.

- Technology Development Fund (TDF): Provides grants to boost cutting-edge defence technology development through public and private industry participation.

- Defence Industrial Corridors: Two corridors in Uttar Pradesh and Tamil Nadu with a ₹20,000 crore investment goal by 2024.

- Test Facility Support: World-class test facilities have been established in DRDO labs for industry use.

- Positive Indigenization List: Two lists with 101 and 108 items to boost local procurement and defense exports.

- SRIJAN Portal: Launched to promote indigenization, featuring 5,569 items for local development as of June 2022.

Key driver no.3: Government Goals for Boosting Defence Exports in the Coming Years

Let’s start by analyzing India’s current export trends, followed by an in-depth look at the government’s futuristic targets for defence production and target.

Where does India stand in arms export:

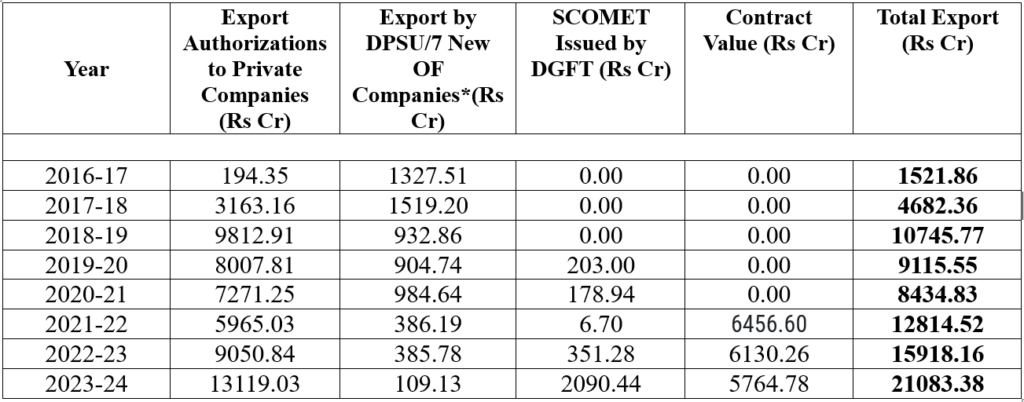

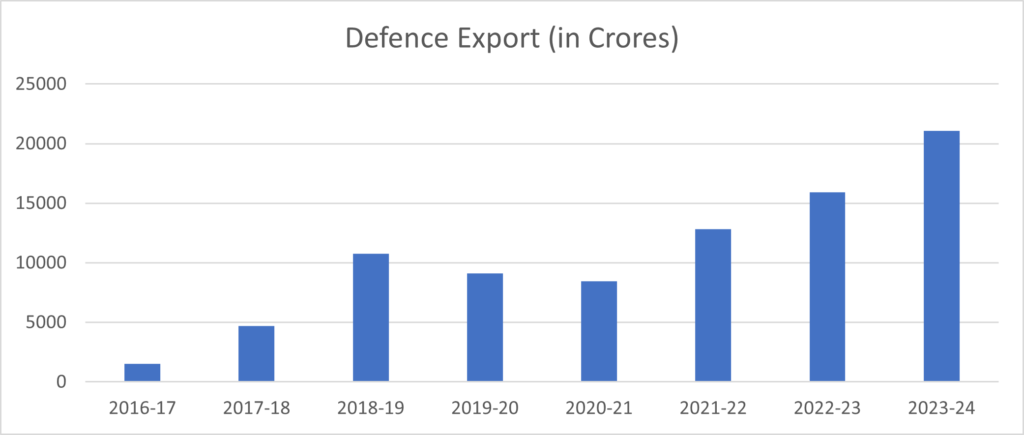

India’s arms exports hit a record high of ₹21,104.67 crore (US $2.63 billion) in FY 2023-24, a 32.5% increase from the previous year. Over the last decade, defence exports have grown 31-fold, from FY 2013-14 to FY 2023-24.

Currently, around 100 Indian defence companies are exporting major arms and components to over 85 countries, including Armenia, Bhutan, Bangladesh, Ethiopia, the Philippines, Maldives, Mauritius, Mozambique, Myanmar, Nepal, Saudi Arabia, Seychelles, Sri Lanka, the UAE, and the US.

India has transitioned from being an arms importer and found a place in the list of top 25 arms exporter nations, the economic survey 2023-24 revealed. The Indian government is making significant strides in this field, but there’s still a long way to go.

Government targets in defence sector:

- Target for 2024-25: Achieve ₹1,75,000 crore in annual defence production, including exports worth ₹35,000 crore.

- Target for 2028-29: Nearly triple annual defence production to ₹3 lakh crore and more than double defence exports to ₹50,000 crore.

Arms exports can help Indian companies grow by expanding market reach and increasing revenue. This boost supports domestic production and innovation, strengthens indigenization efforts, and improves profitability. As companies gain global recognition, they also enhance their capabilities and technology, reinforcing their position in the domestic market.

Note: Key Drivers 2 and 3 are influenced by similar factors as well. However, to avoid redundancy, We have not repeated the points. For instance, the initiatives on indigenization and the goals and targets section apply to both, but we have not restated them.

Investment Opportunities:

how can we, as investors, capitalize on this evolving defence landscape?

The purpose of outlining the previous initiatives is to highlight the significant growth potential for Indian defence companies driven by the indigenization push from the Government of India. With these reforms and policies in place, Indian defence manufacturers are poised for substantial growth in the coming years.

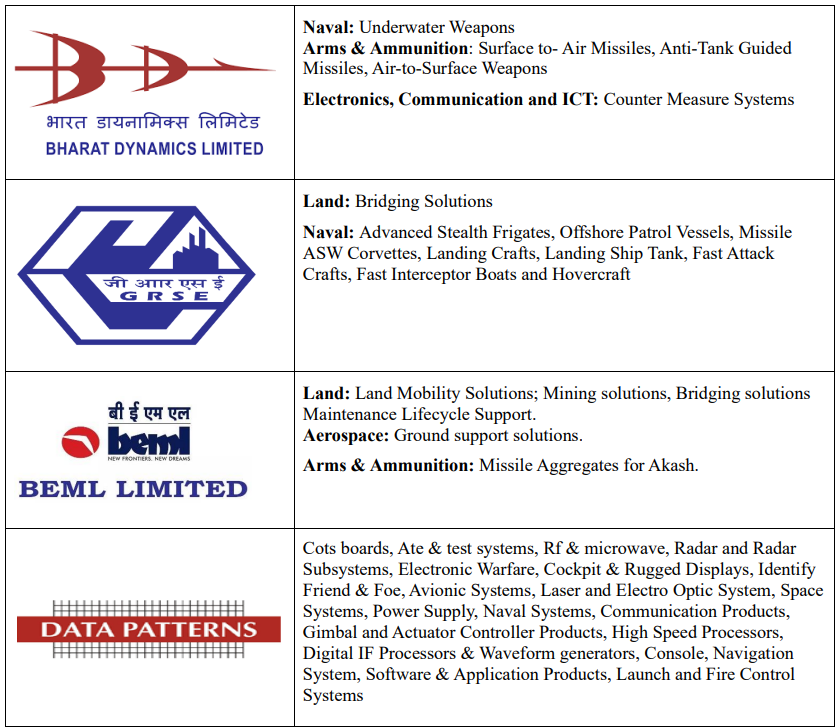

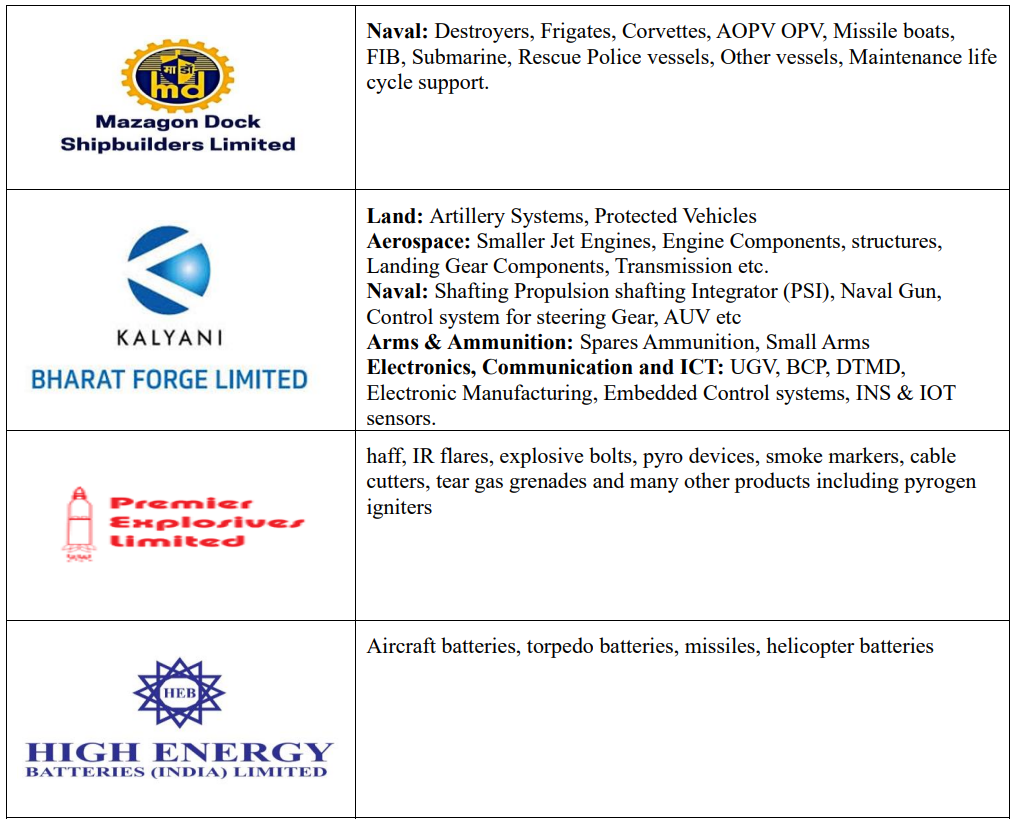

Now, let’s take a closer look at the major companies involved in defence production in India and their related products.

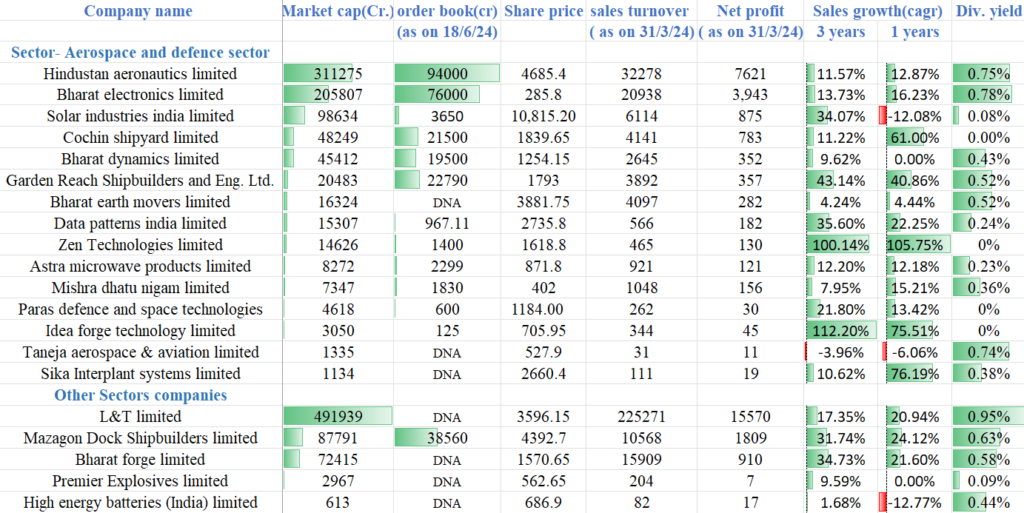

Let’s study the performance of these companies.

We will assess these companies using various criteria, first outlining the criteria and then evaluating performance based on them.

- Market Capitalization: The consolidated market cap reflects all sectors the company operates in. Isolating the defence sector’s market cap is challenging and not publicly available. Market cap represents the total value of a company’s outstanding shares.

- Order book: In the defence sector, an order book is a record of confirmed contracts and future orders for military equipment and services that a company is obligated to fulfill.

- Share price: Share price is the current value of a single share of a company’s stock.

- Sales turnover and net profit: Sales turnover is the total revenue generated from goods or services sold by a company. Net profit is the amount remaining after subtracting all expenses, taxes, and costs from the sales turnover.

- Sales growth: We have included sales growth for both 3 years and 1 year, with CAGR used for the 3-year period. CAGR (Compound Annual Growth Rate) is the average annual growth rate of an investment over a period, assuming steady growth.

- Dividend yield is the annual dividend as a percentage of the share price.

Note: Green bars represent positive outcomes, while red bars indicate negative ones. The color coding facilitates easier comparison between companies. If the bar is larger, it signifies a higher value in that criteria; if shorter, it indicates a lower value.

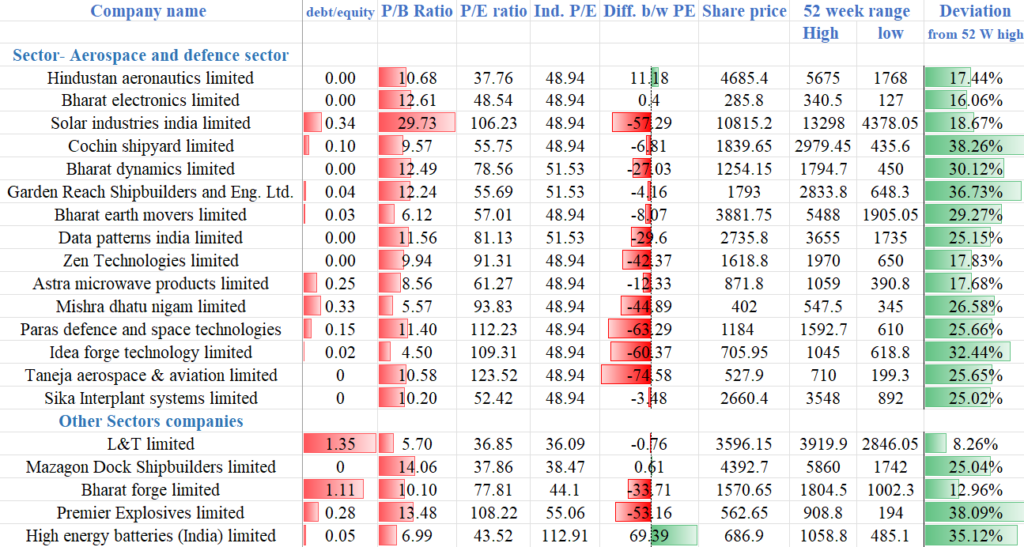

- Debt/Equity: The debt/equity ratio compares a company’s total debt to its equity, indicating financial leverage. A higher debt/equity ratio signals more debt relative to equity, which can be risky but manageable if the company handles debt well.

- P/B ratio: The P/B ratio measures a company’s market price relative to its book value. A high P/B ratio may suggest that a stock is overvalued compared to its book value, but it can also indicate strong investor expectations for future growth in earnings or assets.

- P/E ratio & Ind. P/E: The P/E ratio measures a company’s stock price relative to its earnings per share, while the industry P/E averages this across the sector, helping to compare a company’s valuation against its peers.

- Diff. b/w Ind. PE and company PE: Comparing a company’s P/E ratio to the industry average helps gauge its valuation; a higher P/E suggests growth expectations or potential overvaluation, while a lower P/E may indicate undervaluation or weaker growth prospects.

- 52 Week range: The 52-week range is the highest and lowest prices of a stock or asset over the past year. This range provides a measure of the asset’s volatility and price fluctuations over that period.

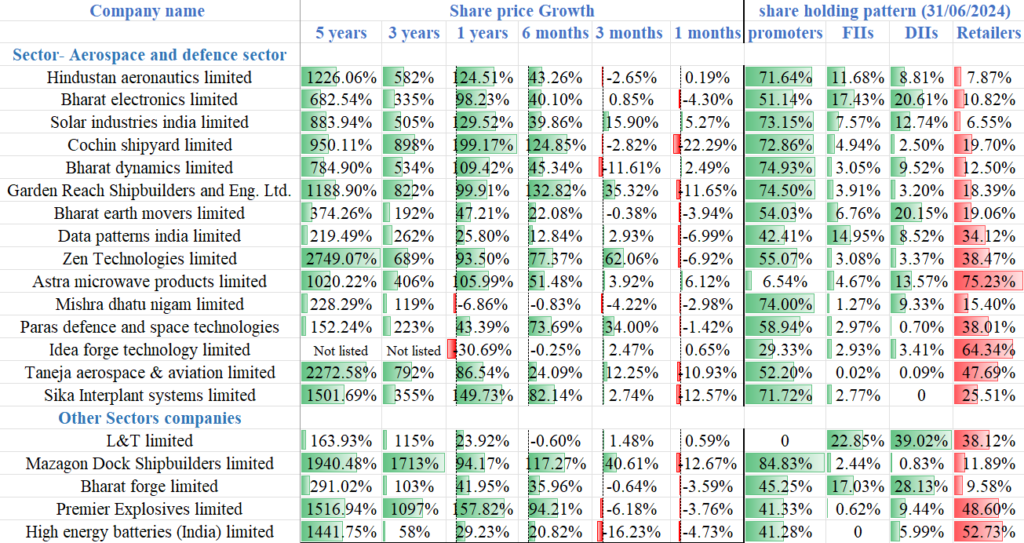

- Share price growth: Share price growth shows how much a stock’s value has increased over time, reflecting the company’s performance and investor confidence.

- Share holding pattern: a) High promoter shareholding means insiders have strong control and confidence in the company. High DII shareholding indicates domestic institutional trust. High FII shareholding reflects global investor confidence. b) High retail participation with low FII, promoter, and DII involvement can lead to increased volatility and reduced stability. It often signals less confidence from experienced investors, potentially affecting the stock’s reliability.

Conclusion:

India, the fourth-largest military spender globally, is poised to invest approximately Rs. 1.5 lakh crore (about $18 billion) each year until 2030 to modernize its military, with a strong focus on procuring indigenous weapons and equipment. This extensive investment presents a substantial opportunity for Indian defence companies and startups to grow and innovate.

Investors should understand that this transformation in the defence sector will be gradual and require persistent efforts from the Indian government to achieve self-sufficiency and establish India as a significant defence exporter. The process will take time and patience, but it holds the potential to fundamentally reshape the defence landscape in the long run.

Personal Advice to my readers:

To capitalize on this opportunity, be disciplined and patient. Consider investing during market dips and use defense indices like the one by Motilal Oswal. Always conduct your own research, trust your findings, and avoid panic during market declines. Diversify your investments within the defence sector and remember, you are responsible for your investment decisions.

Frequently Asked Questions

The Defence Research and Development Organisation (DRDO) is an Indian government agency focused on developing advanced defense technologies for the military.

India is working on projects such as the Tejas Mark II aircraft, Agni-V missile, Nirbhay cruise missile, K4 submarine-launched missile, and Astra air-to-air missile.

Countries like the Philippines, Vietnam, and Indonesia have shown interest in Indian arms, including missiles and naval systems.

Keep it up..

I certainly will. Thank you for your motivating comment.