Key Points to Reflect On

- How did a single report shake up one of the largest conglomerates in India? Were Hindenburg’s allegations genuinely true, or was it just a calculated move to short Adani shares and make a profit?

- What really happened in the showdown between Adani Group and Hindenburg Research? Was it just a battle of market forces, or something deeper?

- Following the controversy, SEBI launched a probe into the Adani Group’s activities, scrutinizing allegations of stock manipulation and financial misconduct. But what were the findings? Did the Supreme Court clear these probes, or are questions still lingering?

What is Hindenburg?

Hindenburg is a financial research firm known for its investigations and reports on publicly traded companies. The firm is often associated with producing reports that allege financial misconduct, fraud, or other issues at companies, which can lead to significant market reactions.

Nathan (Nate) Anderson, Founder of Hindenburg Research LLC

Nathan (Nate) Anderson, CFA, CAIA, established Hindenburg Research LLC in 2017. He studied international business management at the University of Connecticut and spent time living in Jerusalem before returning to the United States. Anderson’s career began with a consulting role at FactSet, a financial software firm, and he later worked with broker-dealer firms in Washington, DC, and New York City. His diverse background and expertise in financial analysis have been pivotal in the success of Hindenburg Research.

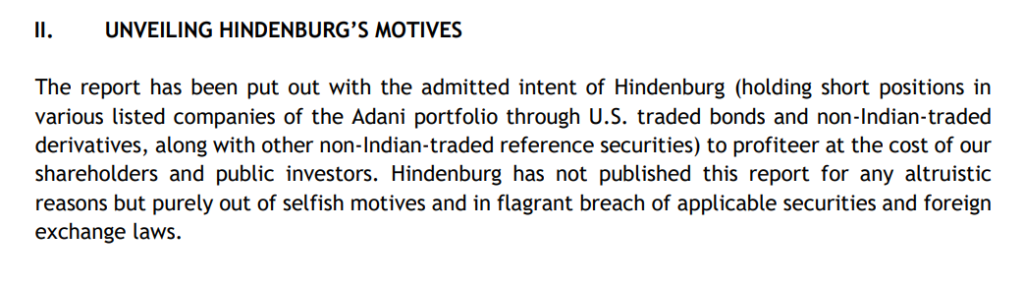

What does Hindenburg get out of this

Hindenburg Research profits by short-selling stocks of companies it investigates. Before public reports, the firm shares findings with select investors, allowing them to short the stock in advance. The firm earns commissions from these investors’ profits. This approach can drive down stock prices, benefiting the firm’s short positions.

Critics argue that short sellers might push prices down with unverified claims, while supporters see them as essential for market efficiency, preventing overvaluation.

An 81% Success rate

Since Nathan Anderson founded Hindenburg Research as a standalone firm in Dec. 2017, it has published reports on 63 companies. This number includes recent reports on Sebi and Buch, bringing the total to 70 reports, including follow-ups.

Among the 63 listed companies that Hindenburg has investigated, three—Ebix Inc., Lordstown Motors, and Sorrento Pharmaceuticals—have filed for bankruptcy. Only 12 of the 63 listed companies targeted by Hindenburg were trading at a higher price as of August 20. This implies that Hindenburg got it right in 51 out of 63 companies it targeted, resulting in a success rate of 81%.

In 2020, Hindenburg Research made a notable impact by securing five of the top ten positions on Breakout Point’s list of best-performing short calls. Demonstrating their dominance in the field, Hindenburg was the most active short seller that year, targeting an impressive 24 companies—twice the number pursued by its closest competitor, White Diamond.

In 2022, Hindenburg’s ten targets witnessed a dramatic average share price plunge of 42%. The following year 2023, their seven targets endured a similarly striking average decline of 36%. By the first quarter of 2024, Hindenburg Research had solidified its position as a leading force in short selling, with two of its shorts—US biotech company Renovaro and Swiss fintech firm Temenos—ranking among the top ten best-performing short calls

Hindenburg Vs Adani

Here’s a timeline of key events following Hindenburg Research’s report on Adani.

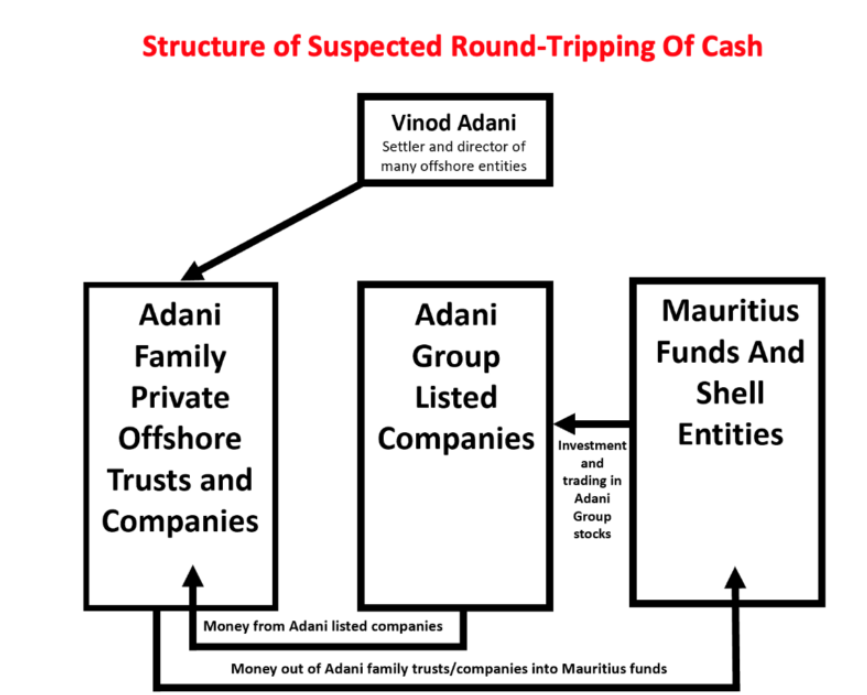

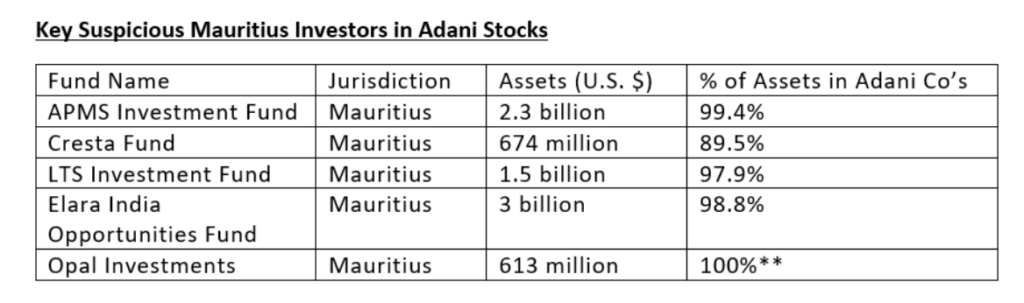

January 24, 2023: Hindenburg Research releases a report accusing the Adani Group of stock manipulation and accounting fraud over decades, alleging the use of offshore shell companies to inflate stock prices and conceal debt. It has also accused the Adani Group of “stock parking,” alleging that offshore funds and shell companies are covertly holding shares in Adani-listed companies, in violation of SEBI exchange regulations.

Read Detailed report released by Hindenburg

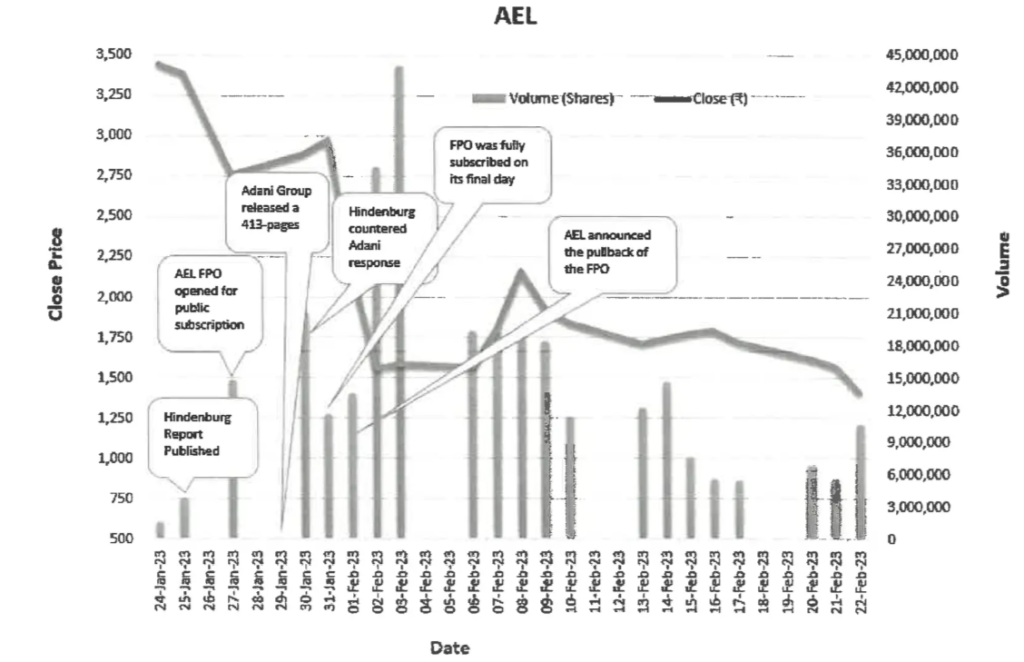

January 25, 2023: Adani Group responds, calling the report “a malicious combination of selective misinformation and stale, baseless, and discredited allegations.” Despite this, Adani’s stocks begin to decline sharply.

January 29, 2023: Adani issues its 413-pages response, in which it dismisses Hindenburg Research’s allegations as “baseless” and “maliciously mischievous,” accusing the firm of making short positions to profit from its own report.

Read Detailed Response of Adani Group

February 1, 2023: SEBI begins investigating the allegations, focusing on potential violations of Indian securities laws, especially stock price manipulation and insider trading.

Adani Enterprises Ltd (AEL) unexpectedly called off its ₹20,000-crore follow-on public offer (FPO), a day after the company closed the offer successfully. The decision followed a 28.5% plunge in its shares in trade that resulted in the stock trading at 31.6% below the lower end of the FPO price band of ₹3,112-3,276 per share. The company said it will return the money collected from investors in the FPO.

February 7, 2023: The Adani Group’s market value falls by over $100 billion. SEBI intensifies its investigation, scrutinizing offshore funds linked to Adani Group stocks.

February 10,2023: The Supreme Court heard a PIL asking for a committee to be set up to investigate these claims.

February 22,2023: During the period from January 24 to February 22, the price of AEL scrip fell by around 59%

March 2, 2023: The Supreme Court asked SEBI to probe the allegations made in the report and determine whether stock price manipulation and other financial irregularities had taken place. SEBI sends formal notices to Hindenburg Research, questioning the validity of their claims and requesting detailed evidence and explanations regarding their report.

March-May 2023: During March to May 2023, SEBI continued its probe into Hindenburg Research’s allegations against Adani Group. On March 14, SEBI requested additional time to complete the investigation, focusing on financial statements, stock trading patterns, and disclosure norms. By April 4, Hindenburg responded, reaffirming their findings and providing necessary documentation. On May 5, the Supreme Court intervened, issuing notices to SEBI and emphasizing the need for a transparent and comprehensive investigation.

May 17, 2023: The court extended the time for SEBI to produce the results of their investigation by August 14.

August 14,2023: SEBI filed an interlocutory application, intimating this Court about the status of the twenty-four investigations which were undertaken by them. SEBI requests Supreme Court to Grant 15 More Days To Complete Adani-Hindenburg Probe.

August 25 2023: Further, SEBI submitted a status report dated providing details about the 24 investigations. Markets regulator SEBI, in an affidavit, informs the Supreme Court that out of its 24 investigations in the Adani-Hindenburg matter, 22 are final in nature, and 2 are interim. SEBI is now awaiting from external agencies on two probes. The interim probes covered 13 overseas entities of Adani’s companies. It has further sought details from five countries on FPIs.

August-November 2023: From August to November 2023, SEBI continued to investigate the complex allegations by Hindenburg against Adani Group. On August 29, SEBI requested an extension from the Supreme Court, citing difficulties in tracing offshore funds. By October 5, SEBI submitted a detailed report outlining key findings and any regulatory breaches. The Supreme Court reviewed this report on October 15, calling for further scrutiny and expert opinions on specific aspects. Finally, on November 24, the Supreme Court reserved its verdict after considering all related pleas concerning the allegations.

December 5, 2023: US government’s International Development Finance Corp, or DFC, following a due diligence investigation of Adani Group, concludes that allegations by Hindenburg were not applicable to Adani Ports.

January 3, 2024: the Supreme Court dismissed a plea requesting an independent probe by the CBI into the allegations. SEBI has stated that it conducted 24 investigations in the matter and 22 of those alleged violations of rules on related-party transactions, insider trading, stock price manipulation, and FPI investments, among others have already concluded. The Supreme Court has given Sebi three months to conclude the two pending probes.

Read detailed Supreme Court order

March 2, 2024: SEBI submits a detailed report to the Supreme Court, finding evidence supporting some of Hindenburg’s claims, particularly regarding offshore entities. However, it stops short of declaring a direct market manipulation violation, recommending further scrutiny.

March-June 2024: Between March and June 2024, SEBI’s investigation into the Adani Group saw key developments. On March 24, the Supreme Court urged SEBI to provide a detailed update on its progress. In response, Hindenburg Research submitted additional evidence on April 15, reinforcing their claims of stock manipulation. By June 10, SEBI presented an interim report to the Court, summarizing progress, preliminary findings, and the investigation’s complexities.

June 27,2024: Sebi issued a show cause notice to Hindenburg Research, accusing the firm of colluding with a hedge fund manager, Mark Kingdon, to profit from the $150 billion market rout of Adani Group stocks. The 46-page notice detailed how Hindenburg allegedly provided an advanced copy of its report to Kingdon two months before its public release, allowing for strategic short-selling of Adani stocks.

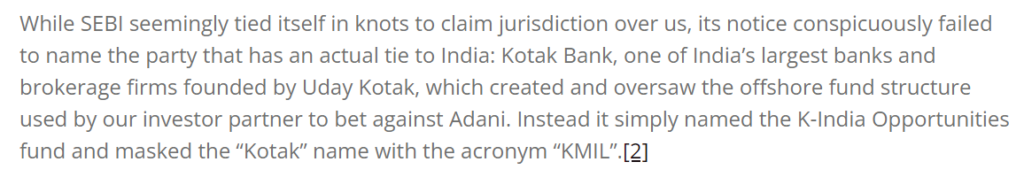

Read Detailed show cause noticeHindenburg also alleged that SEBI is trying to protect another businessmen named UDAY KOTAK from the prospect of scrutiny. Hindenburg alleged that Kotak created and oversaw the offshore fund which was used to bet against adani.

Read Detailed update by Hindenburg

How did Mark Kingdon establish an offshore fund structure to short Adani Enterprises Limited (AEL), what role did Kotak Mahindra play in this arrangement, and how did Hindenburg Capital profit from the offshore fund’s strategy?

We will delve into these questions in detail in our next post to ensure a comprehensive yet concise exploration of the topic.

July 5, 2024: The Supreme Court issues further directives to SEBI, emphasizing the need for a comprehensive investigation into Kotak Mahindra Bank’s role and addressing any identified gaps. The Court sets a deadline for SEBI to expedite the final report.

July 15, 2024: Hindenburg Research publishes a follow-up statement, reinforcing its original claims and highlighting delays in SEBI’s investigation as evidence of challenges faced in addressing powerful corporate entities.

August 1, 2024: SEBI submits its final report to the Supreme Court. The report includes detailed findings on the allegations against the Adani Group, the involvement of Kotak Mahindra Bank, and recommendations for regulatory actions. SEBI requests additional clarifications from Hindenburg Research on specific aspects of the report, focusing on potential market fraud implications and whether the report’s timing and content were aimed at destabilizing the Indian stock market.

August 10, 2024: The Supreme Court delivers its judgment based on SEBI’s final report. The judgment includes directives for any regulatory measures against the Adani Group, Kotak Mahindra Bank, or other involved parties. It also emphasizes the need for improved financial market regulations.

August 14, 2024: Adani Group files a lawsuit in the U.S. against Hindenburg Research, accusing the firm of defamation and market manipulation. Adani claims the report was intended to damage its reputation and financial standing.

SEBI continues its investigation amid increasing pressure from the Indian government and global financial community to conclude the probe and issue a final report. The investigation also includes scrutiny of Kotak Mahindra Bank’s role in the financial dealings associated with the Adani Group.

Hindenburg’s New Target: SEBI’s Chairperson, Madhabi Buch

In a recent development, Hindenburg Research has published a report titled ‘Whistleblower Documents Reveal SEBI’s Chairperson Had Stake in Obscure Offshore Entities Used in Adani Money Siphoning Scandal.’ The report makes serious allegations against SEBI Chairperson Madhabi Buch and her husband. In response, Madhabi Buch issued a statement firmly denying all the allegations.

“The latest note by Hindenburg seems to serve as a follow-up to their previous report on Adani,” said a Delhi-based executive who manages wealth for a billionaire business group. “It’s as if Hindenburg is reaffirming its research on Adani, suggesting that had the regulator conducted an impartial investigation, the truth might have surfaced.”

As this story unfolds, we will prepare a detailed report that thoroughly explains the positions of both parties regarding these allegations.

Frequently Asked Questions

Nate Anderson named his firm “Hindenburg Research” after the Hindenburg disaster, a preventable man-made catastrophe involving a hydrogen-filled balloon. The firm seeks out similar “man-made disasters” in the market, aiming to expose them before more investors fall victim to them.

Short selling is the practice of selling borrowed securities with the expectation of repurchasing them at a lower price to profit from a decline in their value. It involves betting against the market by capitalizing on falling stock prices.

Hindenburg Research reported approximately $4.1 million in gross revenue from shorting Adani Group shares and an additional $31,000 from shorting Adani’s U.S. bonds, which was described as a minor position. Experts suggest that the reported profits are significantly understated and that Hindenburg Research has made substantial gains.

Really informative, got to know all the incidents happened in one article.

Thank you!!